The pressing need for investing

I have always been a saver. I would stash away the cash I got for birthdays and other occasions since I can remember. I saved up money through high school, I saved significant parts of my paychecks from all my jobs in Poland (where I come from). Obviously I would sometimes spend some of that money, but I had a solid habit of saving. When I moved to Ireland at the end of 2015, my Polish savings suddenly became much smaller - I got hit by the fact that now the one month of apartment rent was approximately 4.5 times higher (and let’s not forget about the deposit!). Even though my salary was much higher than in Poland, the cost of living was also significantly higher and very high taxes surprised me. Proportionally to the cost of living I needed a much higher buffer. Anyways, I spent 2016 and 2017 adjusting to the new job, new country and I continued my habit of savings. The company I work at also gives its employees stock as part of the compensation. In 2018 my situation was a quite a lot of cash and stock of just single company. I was aware that it wasn’t optimal. Interestingly, I haven’t had many people who I could follow when it comes to investing, I had literally one colleague back in Poland who mentioned having money invested in the stock market, my parents haven’t really invested, my teammates were mostly expats and they weren’t really thinking about investing or talking about it.

I’ve been thinking that I need to start investing for a while without actually doing anything about apart from doing some ad hoc research it and it was definitely bothering me. I remember that I was reading about investing in the stock market during the cold winter of 2018. I have discovered the FIRE movement of financial independence retire early through some of the Mr Money Mustache blogposts (I vaguely remembered them being recommended by someone and I checked them out). I didn’t get converted immediately, but I generally liked idea of financial stability and saving a lot of money. It seemed like all the US based sources were extremely pro broad market index fund ETFs. They were saying “pour your money over there, it will grow 7% a year on average”. This is obviously very attractive compared to savings accounts or bonds. Do I believe in such high returns for the future? I have to say I am a bit skeptical - not all markets are the same of the US and will the great returns of US stock market continue forever? I am not sure. But anyway, having ETFs is much better than just having a single stock, right?

Then I learned about the Irish taxation rules for ETFs (see an article here). 41% exit tax that you have to pay every eight years, even if you don’t sell it? Oh, gosh! That made the ETF stock investing much less attractive to me, because it was complex and much less lucrative. Which doesn’t mean that I totally gave up on investing in the stock market, but I just haven’t done anything in that direction in the beginning of 2018.

Unexpected opportunity for partnership

During the Easter break in 2018 I visited my family back in Poland and discovered that my younger brother was also interested in the topic of the investment and passive income. Specifically, my brother was learning quite a bit about investing in real estate. I haven’t really been studying the topic before, but the basic ideas of buy and hold real estate investing are pretty simple and real estate income is considered rather stable. My brother and I grew up on an apple farm, which to say the least, wasn’t always the most stable or profitable business. The farm would often have bad years, due to either unlucky weather or poor apple prices. This caused a lot of finance related stress to me and my brother during our childhood and we were both motivated to get financially independent.

We had a bit of Irish whiskey (which I brought from Ireland as a gift to my father) and my brother and I devised a plan to invest together in Lublin, Poland, where my brother lived at the time and the region of Poland I am from.

At that time my brother was still studying and didn’t even have a job (or funds), but was eager to learn more about real estate, become my partner and be the boots on the ground. Moreover his girlfriend was almost an architect (finishing her degree) and her father was a general contractor. In other words - the dream team assembled! We made a deal that would work for both of us: he could live in the place for free for a long time, I would invest all the money and solely own the investment, he would run all the operations and be the boots on the ground. We both left our parents house and I started intensely learning about real estate investing and we both started looking at the available offers in Lublin. As part of my real estate investing I found about the bigger pockets and started listening to their podcast. It is hard to not get excited about real estate if you listen to this podcast and you can learn a lot too.

Investing in Poland while living in Ireland vs investing in Ireland

So, why in Poland? Is Ireland not a good market for real estate investing? That’s not the case, but at that time investing in Poland had several advantages in my situation. For example, I had my brother there that I could partner up, I could by something in cash and fund the renovation in cash and the taxation situation in Poland is much more favorable (since I am not domiciled in Ireland and I don’t remit the income to Ireland, I am taxed using Polish rules). I also wasn’t sure if I will be staying in Ireland for long.

Being a cash buyer is much faster than buying with financing and potentially it also opens up opportunities that wouldn’t be possible with financing. On top of that you don’t have a mortgage after the purchase, so setbacks and long vacancies are much less stressful (and boy, there were some setbacks later with that deal!). Obviously, without a leverage the return would be much lower, but with the low tax rate, it still looked pretty great. And I could always refinance in the future.

On the other hand at that time I didn’t know any Irish investors and everything looked much more expensive in comparison. So, I decided to start investing in real estate in Poland.

Making it happen - Analysis, Viewings, Legal arrangements

With my brother we analyzed quite a lot of properties available for sale online. We were considering two major buy and hold strategies:

- a studio apartment - relatively lower yield, but easier tenant management

- rent by room bigger place - difficult to find big enough place within the budget, but possibly high yields, but more tenants turnover

And I was thinking about a fairly limited budget at that time of 40k Euro, 172k PLN (which later grew… but that’s another story).

My brother worked with some local real estate agents and visited the best looking deals. Once we had a shortlist, I came back to Poland. I checked my flights history and I was back in Poland the same month! This is very unusual to me, because I would usually visit two or three times a year.

Due to the fact that the budget was so limited, many of the available options were very interesting. For example the apartment in the building below was a total disaster. The building looked very nice, but the apartment itself was very old (tile furnace, total renovation required) and in a a poor state - the distinctive feature was that it was painted in vertical stripes of intense green and yellow. Super ugly.

The building itself also had pre-war bunkers as part of the premises and some storage units. Here is a shot of one of the bunkers:

Another beauty I’ve been looking at was an apartment next to Politechnika Lubelska (one of the biggest universities in the region), that would be a perfect place to rent by the rooms. You can see the external elevation below, decorated in the Polish national colors by a Kebab place. Kebab is a primary food for polish students, so the place would definitely cater for that market. It was cheap and had a slightly problematic type of the title that Polish banks generally don’t like and has a bad reputation, because people wouldn’t properly verify it and end up buying something else than they thought. Banks don’t usually finance deals like this and because of that such apartments usually have a discount, which is great for cash buyers.

I believe the apartment above the Kebab place was the cheapest and would yield the highest yield after renovated and rented due to it’s popular location. I had cash, we had a crew capable of getting it renovated. Even though the type of the title was problematic, there wasn’t anything wrong with the title itself (we had a lawyer consult on it) so I decided that I would like to go ahead with the transaction.

Since I wouldn’t be present in Poland for all the formalities, my brother and I arranged a power of attorney document (Pelnomocnictwo) during my trip.

One deal fell through, another deal appeared - acting fast

I got back to Ireland, excited about my soon to be happening real estate deal, but… nothing was happening. The owner started having second thoughts and basically ghosted their real estate agent.

After couple of weeks, we gave up on this. I also started having second thoughts on the type of the title. Maybe I dodged a bullet? Other offers from the batch I visited were significantly less attractive.

And then one Friday I got a message from my brother that he’s just seen a promising offer on OLX, no agent, direct sale from the owner. I checked it and did a quick analysis and the numbers looked great! After a quick chat my brother called the seller and arranged the viewing for Monday. Monday evening I got a shaky video walk through showing me the general state of the apartment. Old, soviet grandma style furnishing, tiled furnace, early 1900 building… We didn’t bother with an inspection. We knew that we would have to do a full renovation. But the number after additional costs would still work pretty well. We knew that the listing price offered a great deal and that we would have to decide fast or otherwise someone will scoop that deal. We contacted the seller the same day with a cash offer at the listing price. We arranged a solicitor for Wednesday that week. I sent the necessary cash to my polish bank account. In the meantime seller set up a bank account in the same bank to get the instantly receive the money from the transfer. My brother met with the seller on Wednesday morning, I was in Ireland, at work. I couldn’t even see the official documents for the title transfer that my brother was signing on my behalf, because of the silly GDPR regulations. I got the details for the transfer and we lodged the amount to the specified bank account of the seller directly. My Polish bank didn’t let it through without multiple phone calls. And then it went through.

The same day, on 6th of June I got my first real estate property investing remotely, without even seeing it with my own eyes. I was excited and I was proud and I didn’t know what I was really getting into.

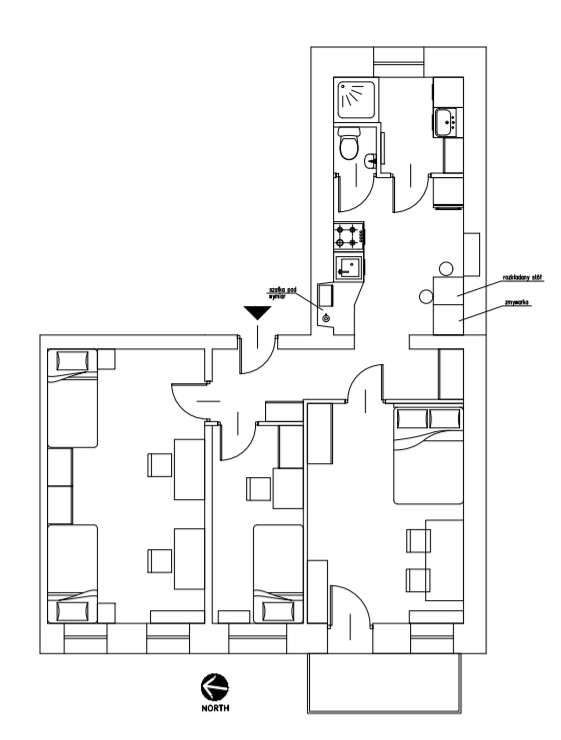

My adventures with getting this property ready, its detailed financials and my general takeaways are a topic for another post. In the end it was transformed into a per room rental with a layout similar to below:

First version of planned layout

We furnished it in a pretty good standard, this way offering a good quality, affordable housing for students and young professionals.

Fancy kitchen :)

Overall, apart from being a great opportunity to learn, it was a great deal financially. I bought that apartment for 160k PLN (~38k euro) and the other costs to get it rent ready were about 60k PLN (14k euro). Currently the property is most likely worth 300k PLN+ (according to sonarhome), so I ended up building quite a lot of equity into it. All the rooms are currently rented and generally it’s not hard to fill them in. The property brings about 2k PLN (~460 euro) a month, 10% of which goes to property management and 8.5% goes to rental taxes. I haven’t had any major repairs so far and other expenses aver very small. The current rate of return is really good, especially since it’s all cashflow and there is no mortgage on this property. It was definitely worth it!

But it wasn’t all that great from the beginning though. It took more than half a year and a major crisis to get the property rented… but that is a topic for another time.