I’ve been on the financial independence journey for many years. My goal was to accumulate enough wealth to never have to work again. Then I could stop working completely and then just do fun stuff.

Well, I decided that this is likely not the best goal for me.

Before you leave this blog, I’m not giving up on the FIRE concept! I’m still a fan, but I think that there is a better way for me. Semi-retirement. If you are curious about the details, take a look at this extensive guide by money flamingo folks.

Problems of traditional FIRE

When you are focused on FIRE, you figure out your FIRE number and then that number becomes your main goal. You start obsessing about the number and the time left to that number.

With that mindset it makes sense to opt for the highest paying job you can get. And once you have that amazing paying job, you don’t want to mess it up. What if you won’t be able to find a similarly well paying job? And that gets you mentally stuck.

Just a couple more years at a very high savings rate and you will have so much money!

Because the thing you are optimizing for is your FIRE number, then it’s really hard to get a less paying job, even if you really don’t need all this money and even if that job makes you miserable.

Additionally once you approach your fire number, then the jump to unemployment becomes pretty scary. It’s easy to delay it for a couple more years to just get a bit more financial security.

There is nothing wrong with having more financial padding. Especially if you were planning to never have active income again in your life. But what if you like to do stuff and are naturally entrepreneurial? You are locking yourself into a setup optimized for earning money and you are likely sacrificing your mental and physical energy for a thing that has less and less value to you due to diminishing returns.

Semiretirement gives you a lifestyle you want earlier

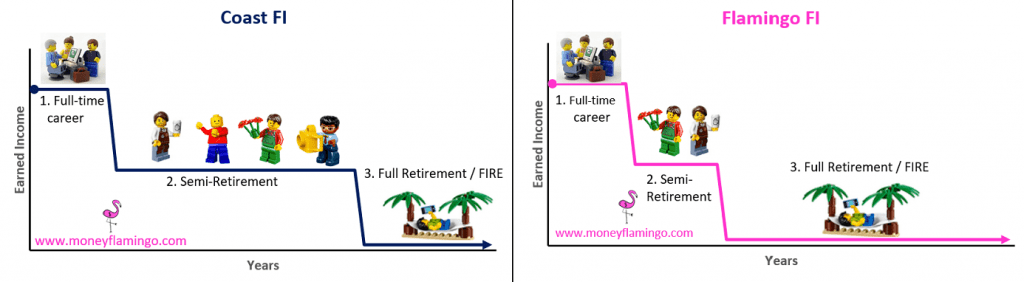

With the semiretirement strategies such as Coast fire or Flamingo fire, you front load your savings and

investments during a couple of years of intense work and then once you have d a significant amount you let the compounding do most of the work to get you to your full FI number.

When the compounding is doing it’s magic, you can take a breather and switch to some less stressful more rewarding work, or to just work significantly less. As long as you cover your basic expenses your nest egg will just grow.

You can do this switch a couple of years earlier compared to waiting for full FI. And the switch would be much less dramatic, which would make it also easier.

For more in depth details, take a look at this extensive guide.

Where I am now and what I plan to do

I have a very well paid job in software engineering that has plenty of responsibility and causes me plenty of stress. I enjoy it sometimes, but sometimes it really drains me. It’s not very aligned with what I want to do, which is software startups or exploring some cooler technologies.

Where am I on the path to FIRE in June 2022?

Almost there. If I moved to a country with less capital gains tax and rearranged my investments, maybe I would be there already. With more conservative assumptions (like safe withdrawal rate ~3%), I’m somewhere less than 2 years away.

I am also very young, 29! So it would be hard for me to imagine rest of my life without working!

How little could I earn to just coast?

My savings rate is something around 80%. My tax rate is about 52% (thanks, Ireland!). So, I could probably be ok with 10% of my income as earning less, I would be paying much less tax. Isn’t that wild?

More money is nice, but even if I worked 80% or even switched to a job that pays third compared to the one now, I would be more than fine and would still be saving up money. So it just doesn’t make sense to stay in this role that is draining me out! I need to change things up!

Adjustments and timeline

My goal for the rest of 2022 is to find and switch to a different role with less responsibility and in a new space. I manage a team now, and leaving abruptly could cause some trouble, so I will do this over several months. It will also give me time to find a role I would really enjoy.

And then in 2023 I plan to leave and do self employment that would be a mix of freelancing and entrepreneurship. If the new role I find is super interesting, I would be willing to stick around for a bit longer, but only as long as I really enjoy it.

Why a new role, instead of switching employers? I think that I haven’t explored all the exciting opportunities I still have with my employer even if I am quite over my current role. Additionally, I would maintain the same pay and benefits (both awesome) and there wouldn’t be hard interviews.

Ideally the new position would be part time, 80%, but if the role is super interesting and matches my other criteria I can make an exception. And if I don’t like it I can always just quit and do what I plan to do next, just a bit sooner.

Entrepreneurship is scary

Why not straight to self employment and entrepreneurship? Because it’s scary! And I’m pretty risk averse.

Last couple years, I’ve been working on side projects and growing my entrepreneurial skills. I could jump to full time entrepreneurship as well, but I don’t feel ready for that yet. With an easier part time job, I think I should be able to get more experience in this space and finally make the leap. Ideally one of my side projects would be able to get some traction already, like earning 100+ euro a month. It wouldn’t have to replace my income, but producing some income would be a good sign.

From a financial perspective, before I make a leap to self employment, I would like to get 2 years of expenses in cash and accumulate a bit more in investments. It’s not really necessary, but would make me feel safer.

With entrepreneurship it’s possible that I would earn nothing for a pretty long time, but there could also be a opportunity for some huge payout down a line if things take off well.